Understanding Multiple Offers

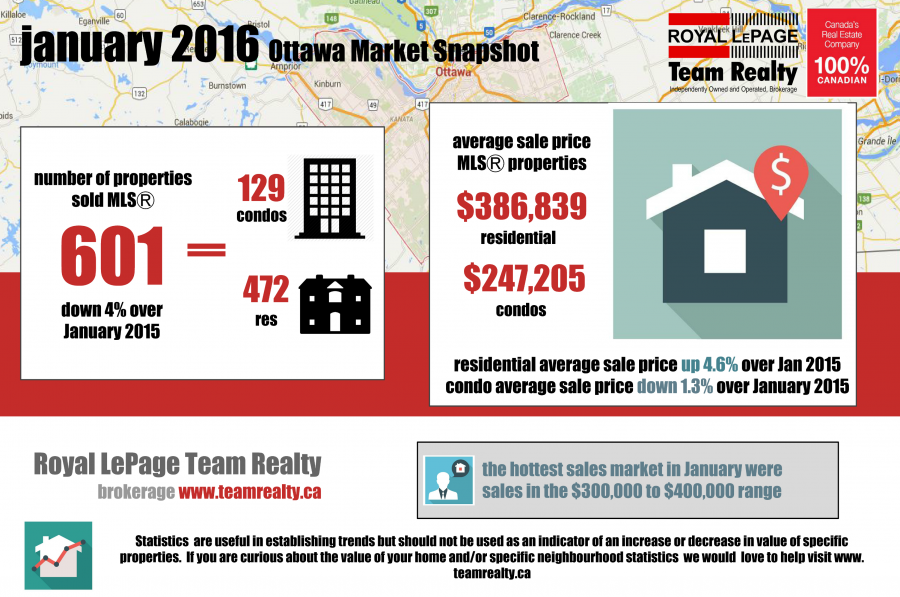

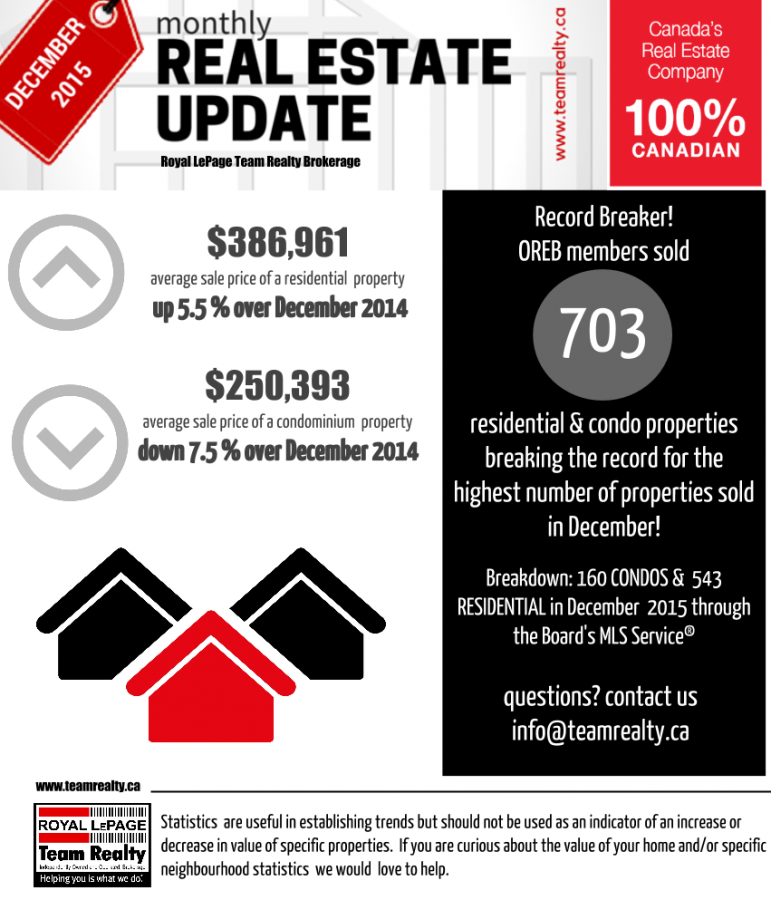

As Ottawa continues to be a hot market with a low inventory, the number of multiple offer situations seems to be on the rise. When a home goes to “multiple offers”, all offers on the home must be made at a set time and the seller is able to choose which one they would like […]

Understanding Multiple Offers Read More »